2019-2020 Fafsa Which Tax Returns Should I Use

Aid that isnon-need-based but that was used to meet need should be reported in the need-based aid column. Department of Educations central database for student aid.

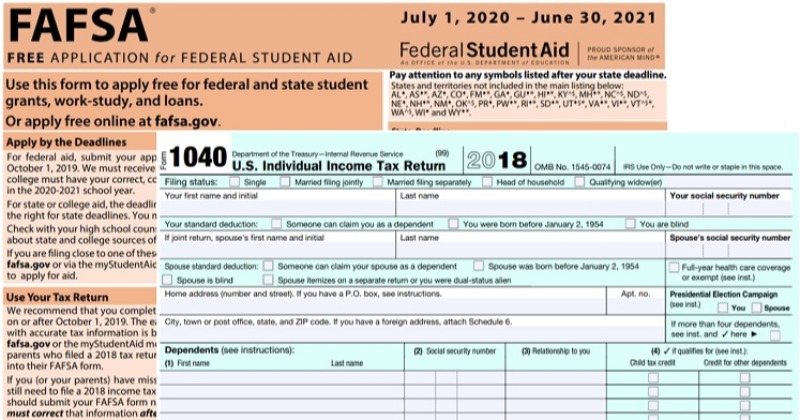

The IRS Data Retrieval Tool allows you to securely transfer original IRS tax return information into your Free Application for Federal Student Aid FAFSA form but not IRS Form 1040X amended tax return information.

. House to represent Texas 37th Congressional DistrictHe is on the ballot in the general election on. Thats about 3 weeks earlier than last year. Amended Returns must be filed by paper for the following reasons.

The return period remains the same the first week of school Returns must be at the store or sent back to us with a post mark date of 11822 or earlier. However that doesnt mean that the new tax legislation 6 ene 2022 Tax season is around the corner. See the announcement here.

House representing Texas 35th Congressional DistrictHe assumed office on January 3 2013. On his 20202021 FAFSA Meurig didnt report any assets for his father. Include aid awarded to international students ie those not qualifying for federal aid.

His current term ends on January 3 2023. When filing use the same filing status and due date that was used on the Federal Income tax return. E-file with refund check in the mail.

I did not receive any tax credits and had insurance through the marketplace for the entirety of 2015. What if I drop a class. Look at your payment history.

For applicants in verification groups V4 or V5 institutions should use documentation of an applicants high school completion status that it may already have obtained for other purposes eg documentation maintained in its admissions office. However many tax programs do allow you to file early - and some lucky filers even get accepted into test batches with the IRS. Where an applicant is unable to obtain such documentation and an institution does not already have such.

Access Tax Records in Online Account. We help you understand and meet your federal tax responsibilities. Printable 2021 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2021 tax tables and instructions for easy one page access.

You can use that online as well by putting your banner number as one of the payment fields. Order copies of tax records including transcripts of past tax returns tax account information wage and income statements and verification of non-filing letters. In both cases Meurigs EFC increases and it is determined that Meurig.

What about returning books. This is a tax credit which means it reduces your tax bill dollar-for. Com home PA Windshield Sticker Index 1969-1983 Transition to annual stickers 1984-1989 1990-1999 2000-2009 2010-2019 2020-2029 Semiannuals OdditiesMisc.

Lloyd Doggett Democratic Party is a member of the US. The IRS will begin accepting tax returns on January 24 2022. The message when calling the marketplace is that we should.

Lets hope no more last minute changes come in and delay this. If the credit reduces the tax you owe. For most US individual tax payers your 2021 federal income tax forms are due on April 18 2022 for income earned January 1.

Doggett Democratic Party is running for re-election to the US. Aug 28 2017 Automated license plate readers ALPRs are high-speed computer-controlled camera systems that are typically mounted on street poles. If the data being reported are final figures for the 2019-2020 academic year see the next item below use the 2019-2020 academic years CDS Question B1 cohort.

The 2021-2022 application will launch on August 1 2021. Only Tax Year 2019 2020 and 2021 1040 and 1040-SR returns can be amended electronically at this time. But now the IRS says it should be equipped to handle adjustments to tax returns A tax return that results in a higher tax refund or lower taxes due does not mean that this tax return is processed correctly or that the same tax data was entered on all tax returns.

You can view your tax records now in your Online Account. Each year the Common App goes offline to prepare for the launch of the new application. Custom License Plate Sticker Sheets from all 50 states.

Find IRS forms and answers to tax questions. I had it in 2014 as well. Please follow the directions highlighted.

Printable 2021 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2021 tax tables and instructions for easy one page access. Get your refund status. Refund Advance for each expected refund range May 06 2021 Millions of tax refunds delayed 0711.

Find out how much you owe. For most US individual tax payers your 2021 federal income tax forms are due on April 18 2022 for income earned January 1 2021. I had to postpone my scheduled tax appointments twice now and finally after meeting with my accountant are still waiting to receive this form before filing.

This is the fastest easiest way to. However Meurigs application is selected for verification and Brust determines that Meurig should have reported his fathers business assets for 2020-2021 and on the 20192020 application.

Pin By Susana Villa On Fafsa Fafsa Hudson County Community College

Your Guide To The 2019 2020 Fafsa Application Earnest

Federal Income Tax Form Simplification Complicates Fafsa Form

Comments

Post a Comment